does idaho have capital gains tax

These would just be taxed as normal income. The deduction is 60 of the capital gain net income included in federal taxable income from the sale of Idaho property.

Idaho Doesn T Review Its Tax Exemptions Billions Go Uncollected Annually Report Says Idaho Capital Sun

Capital gain net income is the amount left over when you reduce your gains by your losses from selling or exchanging capital assets.

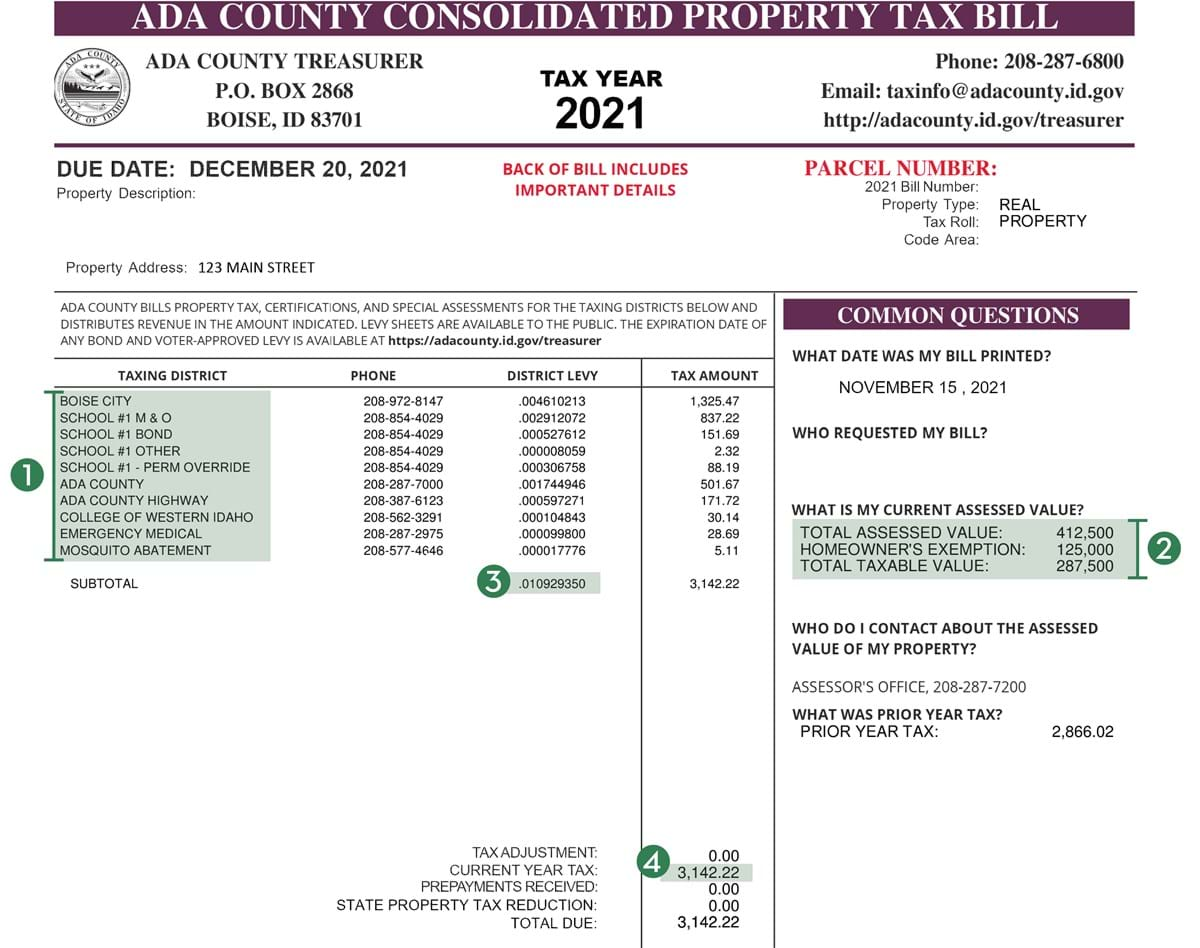

. Section 63-3039 Idaho Code Rules and Regulations Publication of Statistics and Law Who do I contact for more information on this rule. Web In Idaho property taxes are set at the county level. General Information Use Form CG to compute an individuals Idaho capital gains deduction.

Web The good news is that it is possible to sell your house in Idaho and avoid paying capital gains tax. Box 36 Boise ID 83722-0410 Phone. If you found this answer helpful please press the accept button.

Web Idaho does not have a special tax rate for gains and losses on stocks bonds or other intangibles. The combined uppermost federal and state tax rates totaled 294 percent ranking tenth highest in the nation. Web The Idaho Income Tax.

She sold the land for a gain of 100000. Only capital gains from the following Idaho property qualify. Web Section 63-105 Idaho Code Powers and Duties - General Income Tax.

Idahos maximum marginal income tax rate is the 1st. Should I Refinance My Mortgage. A Real property held for at least 12 months.

However the state does not charge this capital gains tax on the sale of traditional currency no matter how much it might have inflated. The land in Utah cost 450000. Web of the capital gain net income included in federal taxable income from the sale of Idaho property.

The rate reaches 693. Idaho does not levy an inheritance tax or an estate tax. Mary must report 55000 of Idaho source income from the gain on the sale of the land computed as follows.

The land in Idaho originally cost 550000. An individual will be exempted from paying any tax if their annual income is below a predetermined limit. Taxes Immigration Labor law Verified If you owned and used the property as a primary residence - the gain - up to 250000 for single.

Web The state of Idaho charges a capital gains tax when individuals sell investments that have appreciated in value. State Tax Commission PO. Calculate Your Capital Gains Tax.

Web capital gain net income included in federal taxable income from the sale of Idaho property. Capital gain net income is the amount left over. 208 334-7846 taxrep.

Gains from the sale of the following dont qualify for the deduction. Capital gains are taxed as ordinary income in Idaho. Like the Federal Income Tax Idahos income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers.

Idaho collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Idaho State Tax Commission Keywords. Web Mary is a resident of Utah.

500000 for married couple - will not be taxable. Only capital gains from the following Idaho property qualify. Web Does Idaho have an Inheritance Tax or an Estate Tax.

Capital gain net income is the amount left over when you reduce your gains by your losses from selling or exchanging capital assets. Web Up to 15 cash back Experience. Property that doesnt qualify.

208 334-7660 or 800 972-7660 Fax. Real or tangible personal property not located in Idaho. She owns a parcel of land that spans the borders of Utah and Idaho.

Keep in mind that if you inherit property from another state that state may have an estate tax that applies. Web Section 63-105 Idaho Code Powers and Duties - General Income Tax. Web Idaho allows a capital gains deduction for qualifying property located in Idaho.

Web period requirement for capital gains purposes. Idaho also has a 600 percent corporate income tax rate. A capital gains tax is placed on any asset that rises in value.

States have an additional capital gains tax rate between 29 and 133.

State Corporate Income Tax Rates And Brackets Tax Foundation

Guide To Combined Reporting Idaho State Tax Commission

Idaho Tax Rates Rankings Idaho State Taxes Tax Foundation

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Capital Gains Tax Estimator East Idaho Wealth Management

Idaho Tax Forms And Instructions For 2021 Form 40

The Ultimate Guide To Idaho Real Estate Taxes

Capital Gains Tax Idaho Can You Avoid It Selling A Home

Historical Idaho Tax Policy Information Ballotpedia

Gold Silver Bullion Laws In Idaho

Idaho Tax Rates Rankings Idaho State Taxes Tax Foundation

State By State Guide To Taxes On Retirees Retirement Strategies Tax Retirement

Capital Gains Tax Idaho Can You Avoid It Selling A Home

Idaho Estate Tax Everything You Need To Know Smartasset

Capital Gains Tax Idaho Can You Avoid It Selling A Home

Idaho Income Tax Calculator Smartasset

Idaho Tax Rates Rankings Idaho State Taxes Tax Foundation

Top 4 Renovations For The Greatest Return On Investment Infographic Investing Infographic Renovations